There are many factors that companies evaluate when deciding where to place their investments. One of them, perhaps the most important, is the complexity of doing business.

In this context, The TMF Group released its 2023 Business Complexity Index, where it surveyed a group of countries along three broad dimensions.: Geopolitical and economic turbulence, compliance challenges and ESG considerations.

“The 78 jurisdictions we cover capture the world’s largest economies and investment centers, accounting for 72% of the world’s population, 92% of global GDP and 95% of net inflows of foreign direct investment (IED),” the study says.

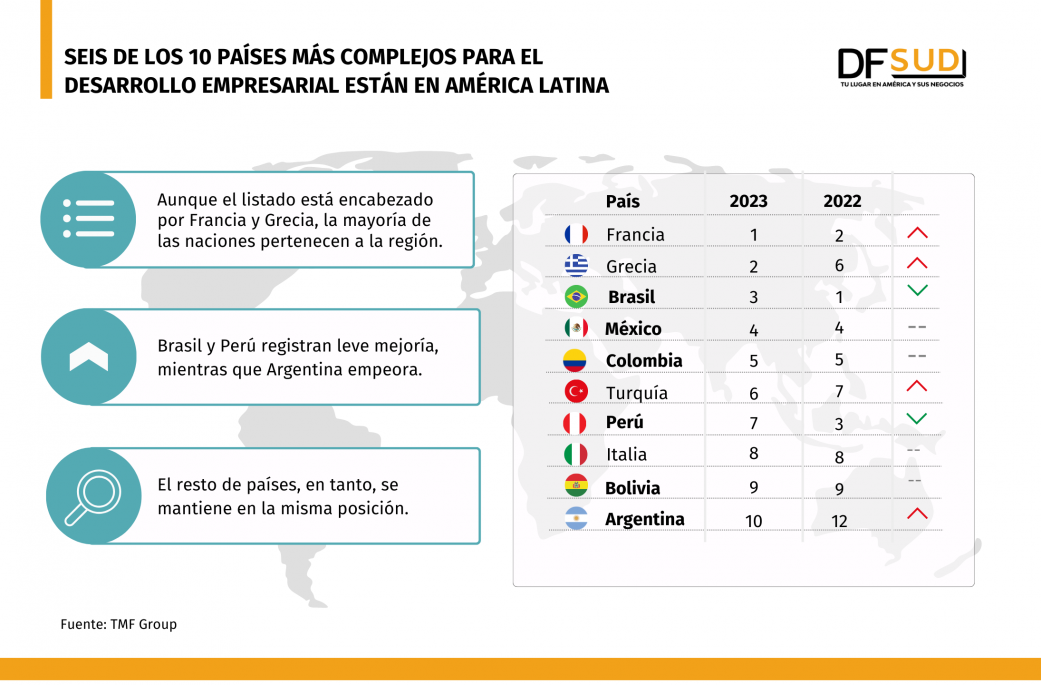

Considering the top 10 of that total, six are Latin American countries. Further down the rankings are six Central American countries and several countries from the Caribbean, such as the Dominican Republic.

Among the 10 most complex, France appears first, followed by Greece, and then the region’s first, starting with Brazil.

The South American giant had three boxes in total, but was first in Latin America. Mexico, Colombia, Peru, Bolivia and Argentina follow in that order.

On the opposite side, the Cayman Islands and Denmark are less complex.

According to the OECD, Latin America could see the world’s largest economic recession this year

Regional profile

Brazil, which topped the list for purposes of the last two years’ editions, slipped to third place in the 2023 measure. Even better, The challenges are many and the complex local tax system is one of the main ones.

That’s because the system is made up of three divisions: city, state and federal, “and these create a densely regulated environment,” the study said, noting that frequent changes to the tax structure are also a stumbling block.

Even so, The Code recognizes that measures have been taken to facilitate the functioning of institutionsForeign exchange control rules and other requirements specifically applicable to foreign investors have been eased since last year.

Additionally, “there is a review of the regulatory environment for financial services, which is expected to simplify processes in the future,” he adds.

Given the challenging global environment, “jurisdictions such as Brazil have become more attractive to investors,” the report notes.

How were stock markets in Latin America during the first semester?Mexico It remains unchanged from the previous version and is back to square four. Its high ranking is mainly due to established processes, “the law (which) can be vague and open to interpretation”.

“There are still many individual requirements, which can present challenges for international companies where senior directors reside elsewhere,” he said.

On the ESG side, he noted that the Mexican government is also facing some controversy because of its stance on renewable energy.“After taking a clear stand to block foreign investment in renewables in favor of more traditional fuel-based energy sources.”

It was located at the bottom Colombia Variations with respect to the previous measurement were not recorded. Among its challenges is the initial difficulty investors have in understanding certain laws and regulations.

“Colombia is a highly regulated jurisdiction, so compliance with its many laws is an essential aspect of operations.”, he noted, while noting that “if the company understands, it will not create much of a problem, but it is an example of the fact that adapting to do business within Colombia can be a challenge at the beginning”.

in politics, Gustavo Pedro cited his political record as an additional factor of uncertainty, and noted that the tax reform approved late last year would bring more complications.

The phenomenon of inflation and consequent demonetisation is also part of the list.

PeruIt ranked fourth in 2022, and was not on the radar of the most complex jurisdictions a year ago – being in Box 24 – and moved up to seventh on this occasion.

Even better, Economy is on the list due to the bureaucracy of some processes“It usually takes 20 days to set up a company, requiring face-to-face interactions with notaries public and lots of registration.”

Lawyers from Chambers and Partners and The Legal 500 rate antitrust authorities in Chile, Peru, Colombia and Ecuador.The latter contrasts with the less complex, a company integration can be solved in hours. Regardless of that now The report also considers other factors, including the recent political crisis, predicting that more time will be needed to “rebuild stability to attract foreign investment”.

However, as a positive point, he highlighted the abundance of natural resources, for which he pointed out that sustainability and other ESG elements are more and more focused, highlighting technological advances at the mining level.

In terms of geopolitical aspects, the inflationary impact resulting from the war between Russia and Ukraine is mentioned, which has affected the prices of some key commodities for that country.

Finally, the last two positions are occupied BoliviaIt remained unchanged from the previous version and Argentina Deteriorated to tenth rank.

In the former case, the need to use Spanish to complete certain processes, along with residency requirements and complex accounting standards, make Bolivia part of this group.

Argentina, on the other hand, appears on the list with complex processes in the consolidation phase, repeatedly changing the rules, to which is added its extreme economic environment.

Brazil, Mexico and Chile lead foreign direct investment in Latin America